In today’s interconnected world, changes in lifestyle choices significantly influence market consumption patterns which is why the investigation into the impact of the Russo-Ukrainian war and the changing climate conditions on the demand and supply of crude oil compared to olive oil in Europe is essential. It can help further our understanding of the influence of the factors on market production and consumption patterns. Europe was selected because it faces direct implications of the effects of war and climate conditions as both issues ultimately arise from the area. Accordingly, the time period of 5 years (2019-2023) provides sufficient duration to analyze supply and demand on each commodity prior during their respective influences.

Olive Oil

Market Analysis

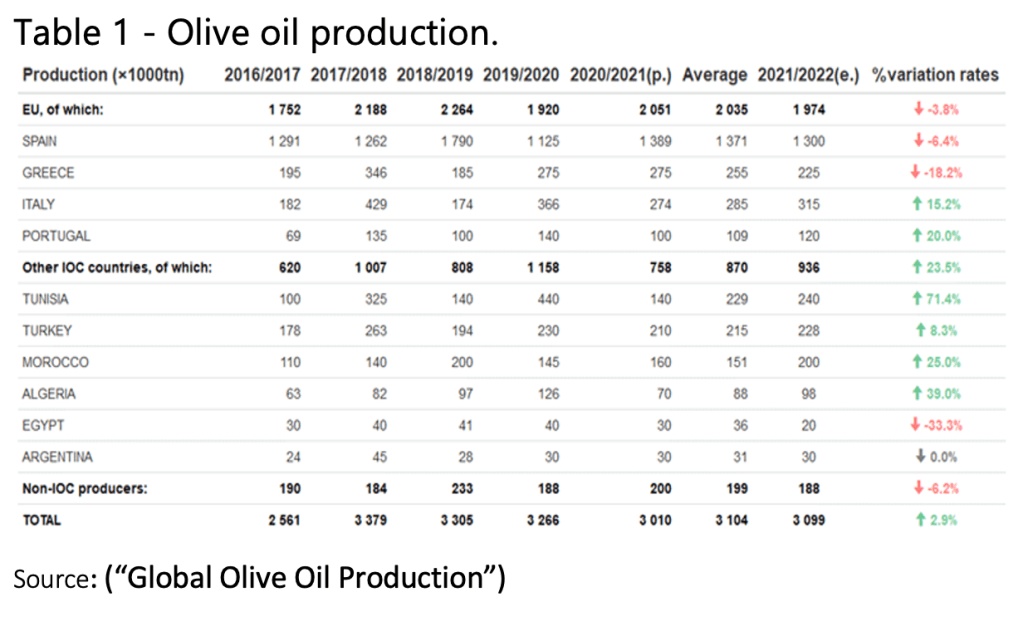

The market for olive oil is thriving; with Europe dominating global consumption and production. Spain ranks the world’snumber one producer, with Greece and Italy following. In the last 60 years, production has tripled (Rocha et al.) This rapid increase is due to technological advancements, with techniques such as pulsed electric field methods improving production and quality. However, climate change has caused a notable decline in olive oil production since 2017/2018, dropping from 3,379,000t to 3,099,000t by 2021/2022 (see Table 1).

The effect of the changing climate conditions

Climate change is seen in rising temperatures and extreme weather events such as droughts, and heatwaves that disrupt the cultivation of olive trees. This leads to reduced yields and lower oil production. For instance, in 2018, an extreme drought in Spain caused regions to experience 50% losses. Similarly, in 2021, a severe frost in Italy damaged olive groves and resulted in a substantial reduction of output.

Furthermore, risk analysis done by the Euro-Mediterranean Center on Climate Change in Europe suggested that in the future there will be a “more desertification, and a rise in hot and dry days throughout the year.” (qtd. in OFI), resulting in olive oil production falling below the lowest yield since 2016/17.

The effect of the Russo-Ukrainian war on the production of olive oil

Another important factor to consider is the Russo-Ukrainian war. From a social aspect, the displacement of populations, disruption of traditional farming practices, and changes in labor availability have all influenced the social landscape of olive-growing regions centered in Europe. These social disruptions can lead to challenges in maintaining consistent production levels and quality standards.

The implications on market prices

The demand for olive oil has always remained high due to its essentiality in the Mediterranean diet. However, in recent years the price has shot up globally with Spain seeing a 112% rise in olive oil prices in 2023.

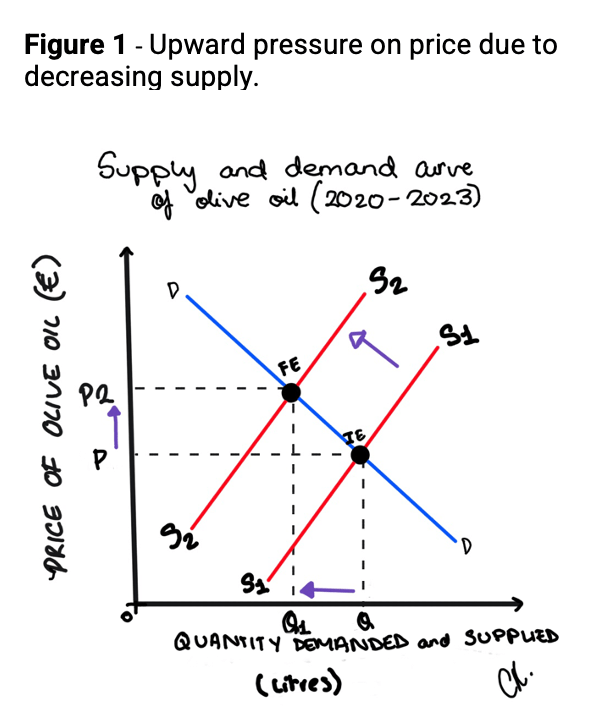

Although the demand for olive oil is ever soaring, the International Olive Council states that the production of the commodity will be about 3m tones short of global demand. Because of this, high demand then exerts an upward pressure on prices, to reduce the demand of olive oil – as per the law of demand, ceteris paribus, the greater the price the lower the quantity demanded.

According to CNN, “After a Spanish drought in 2022, prices of olive oil from Europe jumped 80%, according to the EU” (Nadeau). Looking at Figure 1, it is clear to see how the high demand of olive oil has caused an upward pressure in price in hopes of EU oil production being able to cope with the subsequent lower demand.

Crude Oil

Market Analysis

In recent years, European crude oil market instability surged due to geopolitical tensions and climate shifts. Within Europe, Russia and Norway are among the largest crude oil producers with Germany, and the UK following up as the major consumers relying on it for transportation, heating, and industrial purposes

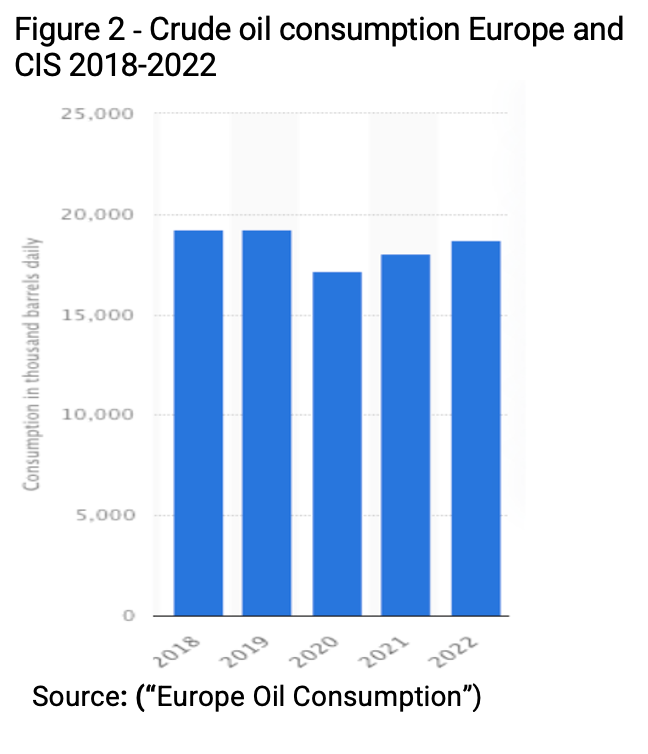

In 2022, approximately 18.7 million barrels of oil daily were consumed in Europe and the CIS (see Figure 2). Although efforts to reduce carbon emissions have led to a small decline, the majority of the region still relies heavily on the commodity and are dependent on the import from its major exporters.

The effect of the Russo-Ukrainian war on the production of crude oil:

The Russo-Ukraine conflict has disrupted its crude oil supply, disrupting critical infrastructure, pipelines, and refineries, essential for the production and transportation. This has caused outages and delays in production. Since the war, the export of Russian natural gasses into Europe has decreased by almost 75%, due to infrastructure disruption. In August 2022, the export company Gazprom reported a significant supply decrease from poor maintenance on the Nord Stream 1 pipeline. (Reuters and Gordeyeva).

Additionally, the rising geopolitical tensions prompted European countries to impose sanctions on Russia, limiting access to international markets, and hurting the supply of crude oil.

The effect of the changing climate conditions on the production of crude oil:

Temperature extremes affect efficiency of production of crude like in Russia when record heat temperatures accelerated the melting of permafrost and damaged 40% of infrastructure in northern regions heavily reliant on oil production (Nichols and Clisby). Furthermore, climate change can also worsen water scarcity where processes require significant amounts of water for extraction and refining.

The implications on market prices:

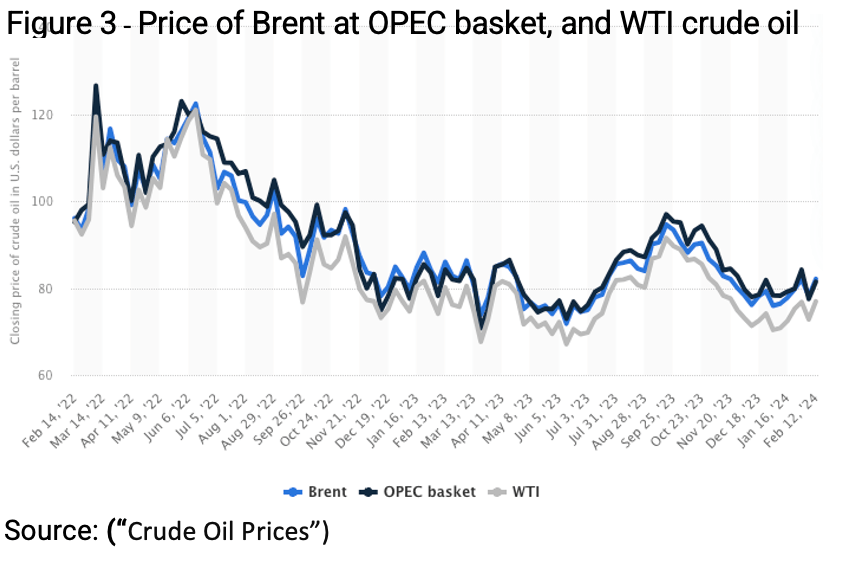

As supply of crude oil decreases, price mechanism – when the forces of demand and supply determine the prices of commodities – details a change in price. As such, the inability to satisfy the demand for crude oil in the EU, creates an upward pressure on price, causing an increase in equilibrium price for any quantity, meaning that consumers will now place a higher value on crude oil. Within Europe itself, the prices of Brent crude have risen more than 30% in the last 3 months of 2023 (Duggan). According to Forbes Advisor, “gasoline prices have followed suit and are up 13.6 cents per gallon from a year ago to a national average of $3.80 per gallon” (Adams).

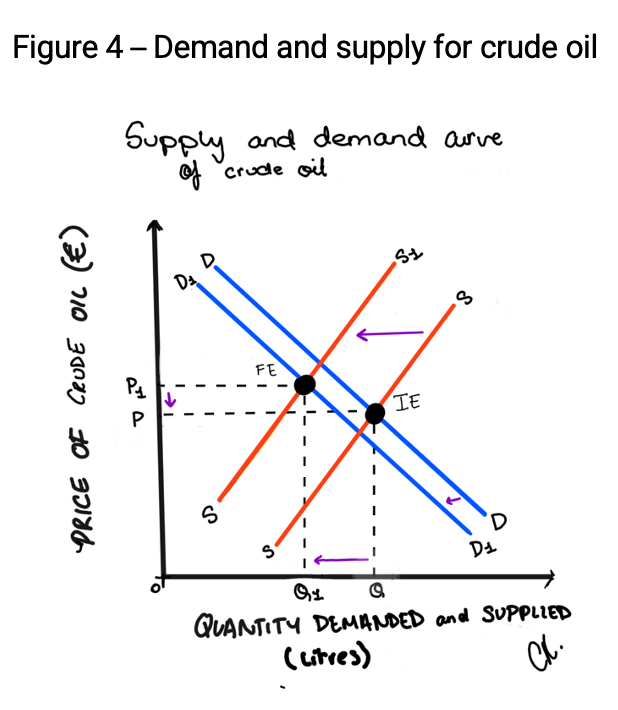

The demand for crude oil is also decreasing: “The shift to a clean energy economy is picking up pace, with a drop in global oil demand as energy efficiency and other technologies advance,” said IEA Executive Director Fatih Birol (qtd. in IEA). As seen in Figure 3, the price of crude oil has significantly dropped since the original shock in 2022, as the lower demand, especially in Europe, pushes downward pressure on prices. The lower demand could partially offset the price increase caused by the decrease in supply (see Figure 4), helping moderate the extent of the price increase or even lead to a lower equilibrium price compared to what it would have been.

Comparison

Despite both experiencing price increases, crude oil and olive oil impact their markets differently based on demand and supply dynamics.

In terms of demand, Olive oil maintains high demand due to its various uses in the Mediterranean diet, remaining strong despite fluctuations in production. Crude oil demand, although high, has shifted due to cleaner energy transitions. Both oils have similar demand levels, but olive oil’s essentiality in diets sustains its relatively, inelastic demand; as seen in Figure 5, the demand for olive oil is steep.

However, transitions to green energy may lead to more elastic demand for crude in the long term (see figure 6). The flatter line indicates the rising elasticity of demand for crude oil as consumers aim for more green practices.

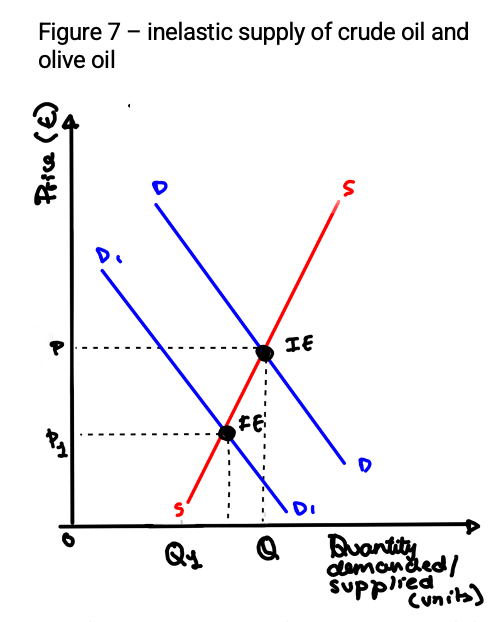

Both crude and olive oil face supply drops. Olive oil production growth is threatened by climate change, reducing future production due to factors like olive tree maturity time and limited production capacity. Conversely, the Russo-Ukrainian war heavily impacts crude oil production, reducing supply due to infrastructure disruptions and trade restrictions. Crude oil supply is inelastic due to costly extraction processes, restricted through a long time period and slow production speed.

As seen in Figure 7, as the demand shifts, marginally small shift for olive oil and a big shift in crude oil respectively, the supply is at a constant because both commodities lack production capacity and time to respond the price changes in the market quickly.

Olive oil prices surged due to inadequate production meeting global demand. Similarly, crude oil prices rose during geopolitical tensions and conflicts. Transitioning to cleaner energy sources may ease some price increases, leading to more moderate rises.

Conclusion

In conclusion, over the past five years, the changing climate conditions and the Russo-Ukrainian war have caused significant impacts on both olive oil and crude oil markets in Europe. These influences have highlighted the complex relationships between geopolitical tensions and environmental changes, shaping the identities of regions and their economic relationships. While olive oil production has faced challenges due to climate change, resulting in fluctuations in supply and rising prices driven by high demand, crude oil markets have been disrupted by geopolitical tensions, infrastructure damage and trade restrictions. All these factors have shaped the way demand and supply affect crude oil and olive oil and contribute an ever-evolving economic scene.

Works Cited

Brito, et al. “Drought Stress Effects and Olive Tree Acclimation under a Changing Climate.” Plants, vol. 8, no. 7, July 2019, p. 232, https://doi.org/10.3390/plants8070232. Accessed 26 May 2020.

Butler, Sarah, et al. “Europe’s Olive Oil Supply Running out after Drought – and the Odd Hailstorm.” The Guardian, 28 Sept. 2023, http://www.theguardian.com/world/2023/sep/28/europes-local-olive-oil-supply-runs-almost-dry-after-summer-of-extreme-weather.

Europe and CIS: Oil Consumption 2022. Statista, 25 Aug. 2023, http://www.statista.com/statistics/332050/total-oil-daily-consumption-in-europe/#:~:text=In%202022%2C%20approximately%2018.7%20million. Accessed 16 Feb. 2024.

Finch, Walter. “Olive Oil Crisis Laid Bare: These Are the Devastating Factors behind a Shock 50% Fall in Production of Spain’s ‘Liquid Gold.’” Olive Press News Spain, 13 Jan. 2024, http://www.theolivepress.es/spain-news/2024/01/13/these-are-the-devastating-factors-behind-spains-shock-50-fall-in-olive-oil-output-over-the-last-two-years/. Accessed 8 Feb. 2024.

Global Olive Oil Production Set for Second Straight Year of Decline. Oils & Fats International, 17 Nov. 2023, http://www.ofimagazine.com/news/global-olive-oil-production-set-for-second-straight-year-of-decline. Accessed 14 Feb. 2024.

Hedgecoe, Guy. “Olive Oil Price Skyrockets as Spanish Drought Bites.” Www.bbc.com, 6 Dec. 2023, http://www.bbc.com/news/world-europe-67565503.

IEA. “Growth in Global Oil Demand Is Set to Slow Significantly by 2028 – News – IEA.” IEA, 14 June 2023, http://www.iea.org/news/growth-in-global-oil-demand-is-set-to-slow-significantly-by-2028.

International Oil Council. “Trends in World Olive Oil Consumption.” OlioOfficina Magazine, 19 Mar. 2016, http://www.olioofficina.it/en/2016/03/20/trends-in-world-olive-oil-consumption/. Accessed 14 Feb. 2024.

Nadeau, Barbie Latza. “Extra Virgin Olive Oil Is Getting Very Expensive. And It Might Not Even Be Real.” CNN, 9 Dec. 2023, edition.cnn.com/travel/olive-oil-fake-crime-expensive/index.html#:~:text=After%20a%20Spanish%20drought%20in. Accessed 16 Feb. 2024.

Nichols, Will, and Rory Clisby. “40% of Oil and Gas Reserves Threatened by Climate Change.” Verisk Maplecroft, 16 Dec. 2021, http://www.maplecroft.com/insights/analysis/40-of-oil-and-gas-reserves-threatened-by-climate-change/. Accessed 17 Feb. 2024.

Oils & Fats International. “Extreme Weather Hits Olive Oil Production.” Oils & Fats International, 19 Apr. 2021, ofimagazine.com/news/extreme-weather-hits-olive-oil-production. Accessed 13 Feb. 2024.

Olive Oil Consumption Set to Outpace Production. Oils & Fats International, 28 Nov. 2020, http://www.ofimagazine.com/news/olive-oil-consumption-set-to-outpace-production. Accessed 14 Feb. 2025.

Reuters, and Mariya Gordeyeva. “Europe Braces for More Cuts in Russian Oil and Gas Exports.” Reuters, 22 Aug. 2022, http://www.reuters.com/business/energy/kazakh-oil-exports-via-russia-hit-by-damaged-equipment-2022-08-22/.

Rocha, Cláudio, et al. “Olive Mill Wastewater Valorization through Steam ReformingUsing Multifunctional Reactors: Challenges of TheProcess Intensification.” Research Gate, Energies, 22 Jan. 2022, http://www.researchgate.net/figure/World-consumption-production-of-olive-oil-data-taken-from-the-site-of-International-Olive_fig2_358168149. Accessed 13 Feb. 2024.

Srinivas, Nidhi Nath. “The Water Problem Is Also an Oil Problem.” The Economic Times, 23 Sept. 2012, economictimes.indiatimes.com/markets/commodities/the-water-problem-is-also-an-oil-problem/articleshow/16507056.cms?from=mdr. Accessed 17 Feb. 2024.

Statista Research Department. “Crude Oil Prices Weekly December 2019 to March 2020.” Statista, 13 Feb. 2024, http://www.statista.com/statistics/326017/weekly-crude-oil-prices/. Accessed 17 Feb. 2024.

Tepper, Taylor. “Why Is the Price of Oil Rising?” Forbes Advisor, 17 Feb. 2022, http://www.forbes.com/advisor/investing/high-oil-prices/. Accessed 16 Feb. 2024.

Thorbecke, Catherine. “Supply, Demand and ‘Geopolitical Tensions’: How Oil Prices Rise.” ABC News, ABC News, 16 Sept. 2019, abcnews.go.com/Business/supply-demand-geopolitical-tensions-oil-prices-rise/story?id=65640000.

Velazquez, jaime. “Spain Hit Hard by Rising Price of Olive Oil.” Euronews, 3 Oct. 2023, http://www.euronews.com/business/2023/10/03/spain-hit-hard-by-rising-price-of-olive-oil-as-climate-change-takes-its-toll-on-production. Accessed 14 Feb. 2024.

Wallace, Joe, and Adria Calatayud. “Trade Tensions, Market Glut Press upon Olive-Oil Prices.” WSJ, 1 Dec. 2019, http://www.wsj.com/articles/trade-tensions-market-glut-press-upon-olive-oil-prices-11575196201. Accessed 8 Feb. 2024.

Leave a comment